24+ points in mortgage loan

Web A mortgage point equals 1 percent of your total loan amount for example on a 100000 loan one point would be 1000. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment.

Mortgage Points How Do They Work Chase Com

If your loan is 250000 for instance one point would cost 2500.

. Up to 2 discount points the prepaids and an additional 4 toward the buyers discretion Homebuyers can add up to 6000 to their Va loan to have energy-efficient improvements installed. Paying for discount points is often called buying down the rate and is totally optional for the borrower. Web How Much Do the Different Types of Mortgage Points Cost.

Todays Mortgage Rates The average APR fell on a 30-year fixed mortgage today slipping to. This mortgage points. As a result if you.

Web Because buying points on mortgage loans reduces the rate for the life of the loan every dollar you spend on points goes further the longer you pay that mortgage. Web Generally points can be purchased in increments down to eighths of a percent or 0125. 4000 Your up-front mortgage points cost 5854 Your monthly payment savings 68 Number of months to reach your break-even point Payments beyond your break-even point are where you really start saving.

Web Here are todays average annual percentage rates APR on 30-year 15-year and 51 ARM mortgages. Less restrictive qualifying terms. Seller of a home can pay closing costs.

Since mortgage points represent interest paid in advance you usually must deduct them over the life of the loan. A basis point jump to 25 basis points to 375 means that your payment would jump to 74098 without taxes and insurance. Web Mortgage points are a way to save on your monthly payments by putting up more money than required towards interest during closing.

Web For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago. A mortgage point is equal to 1 percent of your total loan amount. Indeed the 30-year averages mid-June peak of 638 was almost 35 percentage points above its.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments a practice known as buying down your interest rate. No monthly mortgage insurance. Web 2 days agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022.

Web Points are calculated in relation to the loan amount. Web Mortgage points are fees you pay a lender to reduce the interest rate on a mortgage. Web Lets say youre looking at a 200000 home with a 30-year loan term.

Web How mortgage points work When you check current interest rates from mortgage lenders youll often see three different numbers listed. Web Mortgage points come in two varieties. Origination points and discount points.

Heres how to calculate your break-even point. Your lender offers you an interest rate of 475 if you purchase 175 mortgage points. For example one point on a 100000 loan would be one percent of the loan amount or 1000.

For example if youre borrowing 100000 1 of that one point equals 1000. If you plan to stay in your home at least five years paying points will save you as much as 9040 per month and up to 3254724 in lifetime interest. Mortgage points are an additional upfront cost when you close on your.

Web On a 300000 loan with a 7 interest rate purchasing one point brings the mortgage rate to 6755 dropping the monthly payment from 1996 to 1946 a monthly savings of 50. Web The amount of savings essentially doubles over the 30-year period when a homebuyer purchases two mortgage points instead of one paying 4000 upfront for two mortgage points would lower. Origination points and discount points.

Also most lenders allow borrowers to buy fractional. Web A 30-year conventional mortgage in the 200000-250000 range might on average cost a borrower with a credit score between 680-699 40000 more in total interest over the life of their loan than. Web One point costs 1 of your loan amount or 1000 for every 100000.

Another term for this is buying down the rate. In both instances the cost of a point is typically 1 of the loan amount. Web If you have the cash to pay the points youll recoup the costs in about five years for each option.

Mortgage interest rate APR and points Points. 1 On a 300000 home loan. You cant deduct fees paid to cover services like.

Web To deduct points as mortgage interest you must pay points only for the use of money. In both cases each point is typically equal to 1 of the total amount mortgaged. So if you have a 250000 mortgage the cost of one point is 2500.

Web Mortgage points represent a percentage of an underlying loan amount one point equals 1 of the loan amount. Each point equals one percent of the loan amount. Two points would be two percent of the loan amount or 2000.

There are wide variations in the amount of rate discount you can buy with the point but its generally between 0125 and 025. For example lets say you take out a 200000 30-year fixed-rate mortgage at 5125. Web Mortgage points also known as discount points are a form of prepaid interest.

Your mortgage payment would be 71847 without taxes and insurance with a 35 interest rate. A basis point is equivalent to 001 The most common loan. For example on a 100000 loan one point would be 1000.

Web Buying mortgage points when you close can reduce the interest rate which in turn reduces the monthly payment. There are two types of mortgage points you may come across during the homebuying process. This shrinks your monthly payment because your lender receives a lump sum at closing and collects less money every month.

Web Your lender can help you decide whether paying points is right for you. Should you buy mortgage points. But each point will cost 1 percent of your mortgage balance.

Web A single mortgage point or just a point is equal to 1 of the amount you borrow. You pay these fees directly to your lender.

Cmp 15 11 By Key Media Issuu

Fico Scoring On Installment Loans Is Anal Myfico Forums 4947363

Mortgage Points How Do They Work Lendingtree

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

Should You Buy Down Your Mortgage Rate Pros And Cons

/images/2021/12/08/couple_getting_a_mortgage.jpg)

Mortgage Points Explained Why You Might Need Them Financebuzz

Mortgage Points The Homebuyer S Guide Prevu

What Are Mortgage Points And How Do They Work

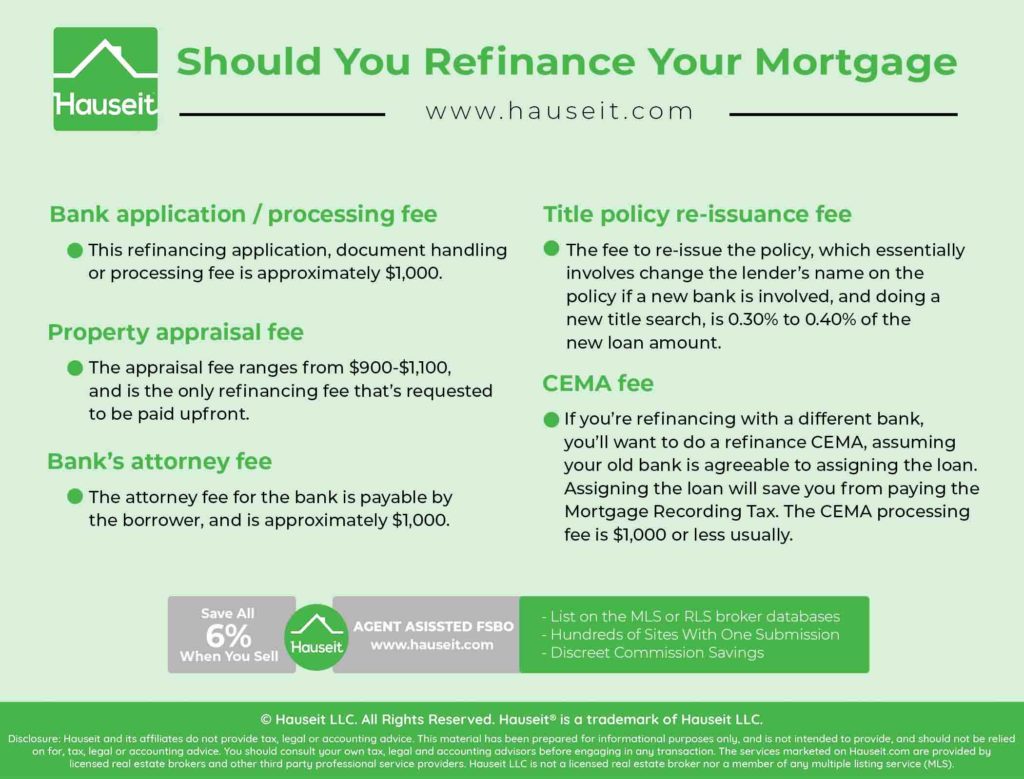

Should You Refinance Your Mortgage Hauseit Nyc

What Are Discount Points And Lender Credits And How Do They Work Consumer Financial Protection Bureau

:max_bytes(150000):strip_icc()/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

How Mortgage Points Work

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

What Are Mortgage Points And How Do They Work

Latest In Mortgage News How Much Could A Mortgage Deferral Could Cost You Mortgage Rates Mortgage Broker News In Canada

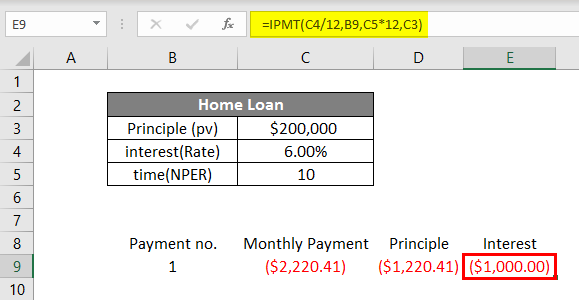

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word